These include system accounts accounts receivable accounts payable retained earnings The 2 accounts I need help with adjusting are accounts receivables and payables. In this video we have tr.

Accounts Payable Journal Entries Most Common Types Examples

At the time of recording an invoice.

Journal entry for account payable. When damaged or otherwise undesirable inventory is returned to the supplier. Accounts payable is a current liability account that keeps track of money that you owe to any third party. Trade creditors or payables or also call accounts payable are the balances outstanding that are to be paid to the creditors or other parties for the supply of the different types of services or products to the company.

It was found that out of the purchases damaged goods were received worth 10000 so it was returned to the. Are there any other ways of doing this. Notes payable journal entry On the date of receiving the loan.

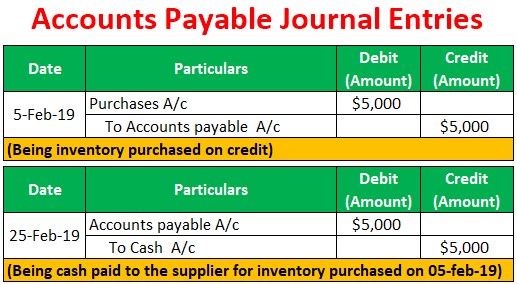

If a part or whole of the. You could set up an accrued payable account to record this entry or as you say since you are 99 or more sure that this is for the accounting fees just set up a payable invoice using a reference like2013 YE 08 to the accountant at year end and a credit note as of the first of the new fiscal year. Journal Entries Related to Accounts Payable Below are two main scenarios linked to the accounts payable cycle where in the first case the credit purchase is recorded and in the second case the cash paid to the supplier is recorded in the books of accounts.

5000 of accounts payable is paid in cash. Journal Entry When the company buys or purchases on credit the liability will occur when goods or services are received. Account payable is the type of current liability where the probability of an outflow of the companys assets is expected to have happened.

30000 of cash is received from taking out a note with the local bank. In each case the accounts payable journal entries show the debit and credit account together with a brief narrative. The journal entry of accrued salaries will increase both the expense account and the liability account.

Accounts Payable Journal Entries video in which we discussed accounts payable situations which commonly occurs when dealing with accounts payable journal ent. One common example of accounts payable are purchases made for goods or services from other companies. Accounts payable AP is an account in the general ledger that represents a companys obligation to pay for items or services purchased on credit.

The typical journal entries related to accounts payable are given below. Accounts payables are the credit nature class shown under the current liabilities section of the statement of financial position. The economic outflow will happen when the entity settlement the liability.

Create a journal entry and a T-Account for each of the following transactions. For this the freight. It is important to learn that how we need to record our credit purchase and the factors which are coming to close the purchase deal.

Received Utilities Bill Accounting Equation The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business. For a fuller explanation of journal entries view our examples section. So accounts payable are what you owe to your vendor or supplier for items or services purchased on credit.

When the company signs the agreement and receives the loan from the bank or creditor. Typical Accounts Payable Journal Entries. The credit entry represents the liability to pay the supplier in the future for the use of the utilities.

The third parties can be banks companies or even someone who you borrowed money from. Company purchased the inventory worth 50000 with terms 210 n30 FOB shipping point. At period-end adjusting entry.

Accounts Payable Journal Entries Example 2 Feb 02. When merchandise inventory is purchased on account. Page 3 Helenas Academy Payroll Journal 10012020 to 12312020 Account Number Account Description Debits Credits 2300 Vacation Payable-12870 2310 EI Payable-8390 2320 CPP Payable-20228 2330 Income Tax Payable-20822 2400 RRSP Payable-2500 2430 Medical Payable - Employee-4400 2440 Medical Payable - Employer-4400 2460 WCB Payable-2518 10312020 J27 DD60 Teicher Lars 5250 Wages.

The accounts payable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts payable. Without the ability to create a manual journal entry I am looking for a workaround. In normal business activities the account payable occurred when the entity receives goods or services from its suppliers while the payment is pending until the company release the payment to its supplier.

Likewise it will affect both the income statement and the balance sheet after adjusting entry. If merchandise inventory is purchased on account the accounts. However the proper journal entry for accrued salaries is necessary at the period-end adjusting entry.

Hence the company will debit goods received or services expended and credit accounts payable as liabilities increase. At the period-end the company needs to recognize all accrued expenses that have incurred.