A lease not meeting the above criterion is categorized as an operating lease. For example if the present value of all lease payments for a production machine is 100000 record it as a debit of 100000 to the production equipment account and a credit of 100000 to the capital lease liability account.

Financial Statement Presentation For Capital Leases Dummies

Because the company isnt paying these expenses for nothing they get benefit from them and record them as assets on the balance sheet operating lease right-of-use assets.

How to record capital lease on balance sheet. Calculate Present ValueAs we have already calculated under the capital lease criteria test our present value. The liability column should have an entry on it titled Auto Lease or Lease Liability. The lessee needs to report the lease liability and the leased asset on the balance sheet.

Typically these leases are in relation to property plant and equipment PPE so the capital lease assets were recorded in PPE while the lease liabilities were recorded in debt or other liabilities. Credit the liability column next on the balance sheet for the lease purchase price minus any down payment trade-in amount received and interest computation. Record the amount as a debit to the appropriate fixed asset account and a credit to the capital lease liability account.

Brought to you by Techwalla. In order to record the lease liability on the balance sheet we need to determine the lease term. Operating leases on Balance Sheet In the past because the lessee did not in substance own the asset in an operating lease the leased asset did not appear on the lessees Balance Sheet.

It provides guidelines on how the capital lease asset should be recorded by the business in its balance sheet income statement and cash flows. In accounting for a capital lease the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor. Now that the lease is recognized on the balance sheet you must account for the rental payments.

These figures must reconcile. Capital Lease vs Operating Lease. Both the lease and the asset acquired under the lease will appear on the balance sheet.

To record the periodic depreciation charge. On the balance sheet side I added the present value of the future minimum lease payments discounted by a consistent cost of debt to my measures of Invested Capital and Operating Debt. On January 1 each year you must make a payment to recognize your lease payments to the lessor.

Pull the numbers for the liabilities from the lease amortization schedule. A capital lease or finance lease is treated like an asset on a companys balance sheet while an operating lease is an expense that remains off the balance sheet. Steps to Capital Lease Accounting Step 1.

Record the journal entry to recognize each rental payment. Unlike operating leases that do not affect a companys balance sheet capital leases can have an impact on companies financial statements influencing interest expense depreciation expense. Calculate Interest ExpenseHere because the lease payment is to be made at the beginning of each month the.

To do this you would debit Lease Payable for 12000 and credit Cash for 12000. By capitalizing an operating lease a financial analyst is essentially treating the lease as debt. With operating leases you only record each lease payment as an operating expense and you dont include the asset on the balance sheet.

Following the principle of substance over form assets are recorded in books of the lessee as fixed assets. A capital lease referred to as a finance lease under ASC 842 and IFRS 16 is a lease that has the characteristics of an owned asset. Find out when date of the change is and whether and organisation of your size will be affected.

Figure accumulated depreciation by multiplying the monthly amount of 26701 by three months October November and December. The capital lease accounting journal shows how the asset is recorded as if it had been acquired by the business the deposit is paid using cash and finally the liability under the capital lease for the outstanding principal amount is recorded. Contract hire operating leases have traditionally kept cars and vans off balance sheet but new IFRS 16 rules from the IASB mean certain businesses will need to account for leasing ON balance sheet.

If the lessee is entitled to all the risks and rewards that are related to ownership the lease is categorized as a finance lease. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt. Instead the lessee only recorded regular operating lease payments as an expense on their Income Statements.

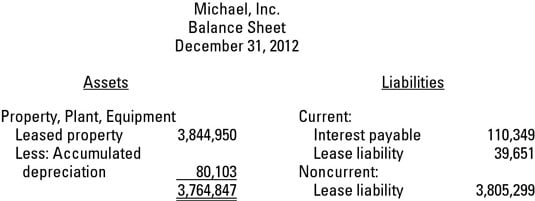

Capital lease refers to a type of lease where all the rights related to the assets are transferred to the lessee and lessor only finance the asset. Think of a capital lease as more like owning a piece of property and think of an operating lease as more like renting a property. Following is a partial balance sheet reflecting the lease transaction.

The liabilities that they owe over the life of the lease is also recorded operating lease liabilities. Determining the lease term sometimes requires judgment particularly when we have renewal and termination options as part of the lease agreement see December 2019s blog for additional insight on the lease term. Prior to this new accounting standard GAAP required the assets and liabilities associated with capital leases to be on a companys balance sheet.

With capital leases you record the asset on the balance sheet and record related operating expenses to your expense sheet.