One of the elements of partnership flexibility is the fact that partners can decide how to split up income and losses -- in fact the allocation percentages do not have to equal ownership percentages. In other words profit is determined before the deduction of partners salaries.

Partnership Defined In Accounting Terms Dummies

L Allocation of profits involving minimum guaranteed profit to a partner.

Partnership accounting for dummies. As a bookkeeper for a partnership you need to collect the data necessary to file an information schedule called Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc. 10000 each even though this has not been taken as income or taxed on the drawings taken in that tax year. Partnerships avoid the double-taxation feature that corporations are subject to because all profits and losses pass through the business to its partners.

L Reconstitution of the partnership firm. Partnership taxation Partnership taxation is the default tax status for limited liability companies with more than one member. Partnership - Profit allocation drawings and payment of tax.

Table of Contents Cover Introduction About This Book Foolish Assumptions Icons Used in This Book Beyond the Book Where to Go from Here Part 1. Its a form of pass-through taxation. L Adjustment for wrong allocation of profits and losses.

A withdrawal account is used to track the amount taken from the business for personal use. A partnership trades makes a profit of 20000 which is shared 5050 between two partners. ACCOUNTING FOR PARTNERSHIP BASIC CONCEPTS 5 13 Special Aspects of Partnership Accounts Following are the specific issues that require special attention in case of partnership accounts.

The partnership dissolves but the business does not end when a partner leaves or joins. Partnership - Profit allocation drawings and. To keep things simple however lets assume that Jerry Tom and Bill from our example earlier allocate both income and losses based on ownership.

Run a small self-employed business for example sole trader or partnership have a turnover of 150000 or less a year If you have more than one business you must use cash basis for all your. Is each partner taxed for the year on the profit allocation ie. Partnerships can even have one allocation formula for profits and a different formula for losses.

A partnership is also called a firm. Tax Forms for Partnerships. The main difference exist in accounting for equity.

During the year each partner takes drawings of 5000 leaving 10000 of the profit in the partnership bank account. Partnership capital accounts reflect a partners economic investment The value of a partnership interest can be determined assuming a hypothetical sale of the partnership assets at their fair-market value A partner who contributes more generally owns more of the partnership interest than the partner who contributes less. The acts of one partner binds the others.

A partnership is a business run by two or more persons who agree to contribute assets to the business and share in the profits and losses. Income allocation in partnership accounting. Opening the Books on Accounting.

Each partner has a claim on the assets or the partnership. Partnerships also differ from corporations with respect to owners liability. General partners are subject to unlimited liability.

A partnership treats salaries paid to partners at least to its general partners as distributions from profit. This Book deals with Accounting Workbook For Dummies is largely about business accounting. L Ascertainment and allocation of profit and losses.

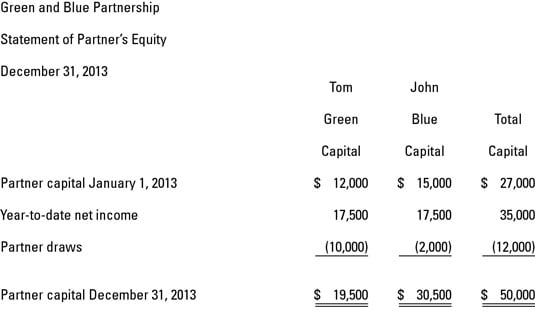

The partnership is a separate legal and accounting entity. Each partners share of the net profit from the bottom of the PL account is added to his capital account and his drawings are deducted from it - together they comprise the movement on the capital account in the year. Instead all money earned by the business is split up among the partners.

If a business cant pay its debts its creditors can reach into general partners personal assets. Capital account As Pedant has indicated it is the partners capital accounts which are included in the balance sheet. Except for the number of partners equity accounts accounting for a partnership is the same as accounting for a sole proprietor.

Everyday low prices and free delivery on eligible orders. 9780470747162 from Amazons Book Store. If your unincorporated business is structured as a partnership meaning it has more than one owner it doesnt pay taxes.

Accounting for assets and liabilities in a partnership is much similar to accounting in any other form of business. Each partner has a separate capital account for investments and hisher share of net income or loss and a separate withdrawal account. L Maintenance of capital accounts of partners.

Since there are two or more owners separate capital accounts are maintained for each owner and special journal entries are required to account for withdrawals. Each partner has unlimited liability. And l Dissolution of the firm.

Buy Accounting Workbook For Dummies UK Edition 1 by Kelly Jane Tracy John A. If the partnership is a CT Partnership you should return details for all classes of the partnerships income and so on both untaxed and taxed for the partnerships accounting period or. It explains how business transactions are recorded in the accounts of a business and the financial statements that are prepared for a business to report its profit and loss financial condition and cash flows.

LLCs are more likely to treat salaries paid to owner-managers as an expense as a corporation does. You dont see this term used to refer to a corporation or limited liability company nearly as often as you do to a partnership. A partnership or LLC are the main alternatives to the corporate form of business.