Contribution margin as a percentage of sales revenue. With our tool you need to enter the respective value for Variable Cost per Unit and Sales Price per Unit and hit the calculate button.

Contribution per unit selling price per unit less variable costs per unit Total contribution can also be calculated as.

How to calculate contribution margin per unit. How to Compute Contribution Margin Figure total contribution margin. Contribution margin per unit formula would be Selling price per unit Variable cost per unit 6 2 4 per unit. Of units of C sold 66750250 267.

Work out contribution. Contribution per unit x number of units sold Lets look at a simple worked example of contribution. Alternatively contribution margins can be determined by calculating the contribution margin per unit formula and the contribution ratio.

Divide this number by your revenue per unit to express it as a percentage of revenue. Contribution Margin Per Unit Per Unit Selling Price Per Unit Variable Cost. Fixed costs and variable costs.

Now lets try to understand the contribution margin per unit with the help of an example. Heres the Contribution Margin Formula Contribution Margin Net Sales Total Variable Expenses. Contribution Margin per unit calculator calculates the contribution margin per unit and contribution margin ratio.

Contribution margin per unit measures how the sale of one additional unit would. Thus the calculation of contribution per unit is. Total revenues - Total variable costs Total units Contribution per unit.

The contribution margin per unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution Margin per UnitSales Price per Unit-Variable Cost per Unit. Calculate the unit contribution for each product line to find the margin. In simplest terms the contribution margin of an item is its price -- the revenue it.

This formula shows how much each unit sold contributes to fixed costs after variable costs have been paid. Mathematically it is represented as Unit Contribution Margin Sales Total Variable Cost No. Production costs fall into two broad categories.

Contribution margin is a concept often used in managerial accounting to analyze the profitability of products. To calculate Contribution Margin per Unit you need Variable Cost per Unit V and Sales Price per Unit SP. It is useful for establishing the minimum price at which to sell a unit which is the variable cost.

How to calculate contribution Margin from Balance Sheet. You can use these same methods to evaluate various product or business lines just group your numbers accordingly. Contribution Margin Calculator - calculate contribution margin which is the differences between a companys net sales and variable costs.

To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. When only one product is being sold the concept can also be used to estimate. How to calculate unit contribution margin December 13 2020 Unit contribution margin is the remainder after all variable costs associated with a unit of sale are subtracted from the associated revenues.

Contribution ratio would be Contribution Sales 200000 300000 23 6667. Contribution margin ratio when expressed in percentage is known as contribution margin percentage. Contribution would be 4 50000 200000.

Contribution Margin of B 23850 no. Contribution Margin of C 23850 no. To find the unit contribution margin subtract each stuffed animals selling price from its variable costs.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. As we can see here that while the revenue share is largest for Product B it is Product C which has highest Unit Contribution margin.

Contribution Margin For More video link given below of Playlist link Balance Sheet. Find Contribution Margin Per Unit Subtract your total cost per unit from your revenue per unit to get your contribution margin per unit. It can be computed by either dividing contribution margin per unit by the sales revenue per unit or total contribution margin by total sales revenue for a specific period.

How To Calculate the Contribution Margin Per Unit and in Total Two Kinds of Costs. Contribution Margin Per Unit Its also common for management to calculate the contribution margin on a per unit basis. Calculate contribution margin per unit.

Of units of B sold 32500250 130. Unit Contribution Margin Selling Price per Unit Variable Cost per Unit Alternately the formula for UCM can be expressed as the difference of sales and total variable cost divided by the number of units sold. A single products contribution margin is given with the formula P - V where P is the cost of the product and V is its variable cost the costs associate with resources used to make that item specifically.

Total contribution margin measures the amount of contribution margin earned by the.

Excel 2010 Posts 1726. Type ipmt b2 1 b3 b1 into cell b4 and press enter.

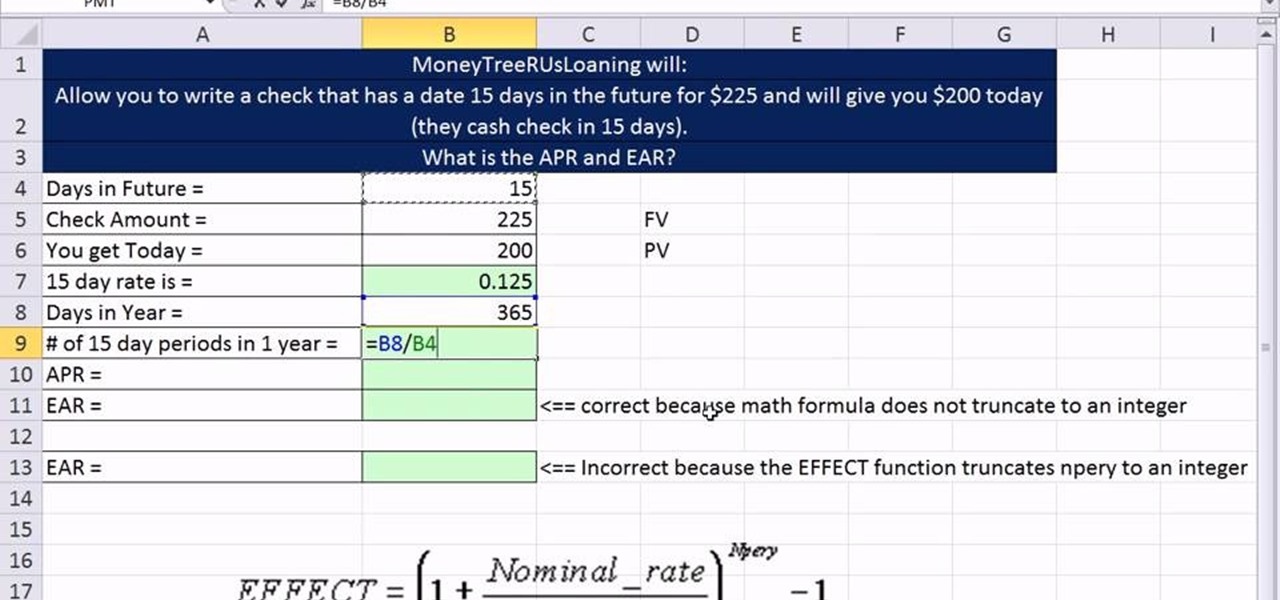

How To Calculate Apr Ear Period Rates In Microsoft Excel 2010 Microsoft Office Wonderhowto

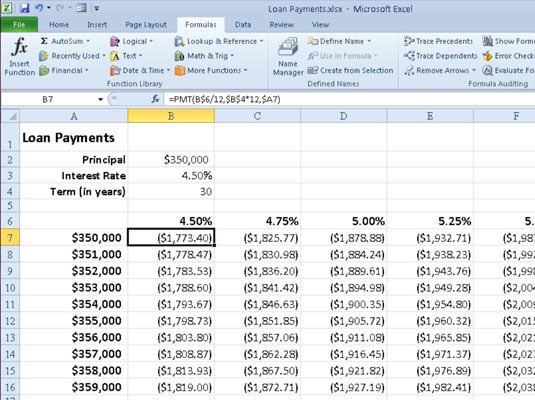

We use the PMT function to calculate the monthly payment on a loan with an annual interest rate of 5 a 2-year duration and a present value amount borrowed of 20000.

How to calculate loan payments in excel 2010. Calculate the monthly payment on a 10 year 50000 loan with an interest rate of 5. The PMT function uses the following syntax. Enter the amount of remaining payments in the Periods row.

A loan payment calculator is a must-have tool if youre planning on taking out a loan. PMT C6 12 C7 - C5. To create a loan schedule we will use the different formulas discussed above and expand them over the number of periods.

Enter the interest rate into the Interest row. We have named the input cells. I show the 0 grace period row 1 to demonstrate the effect of approximating the payment.

Please Login or Register to view this content. How to Use Excel PMT Function to Calculate a Loan Payment. Type IPMTB2 1 B3 B1 into the cell.

We use named ranges for the input cells. I am considering buying a car. Based on that assumption the principal would be the following for the corresponding grace periods and approximate payments.

The result is a monthly payment not including insurance and taxes of 966 28. This will allow you to be more accurate in your personal budgeting and to allocate adequate funds for your monthly payments. For versions of Excel.

Using the function PVrateNPERPMT 19000-PV2912 312-350. Its a good way to determine how the loan amount its interest and the loan term affect the total amount youll be paying. In the example shown the formula in C10 is.

If you like this topic please consider buying the entire e-book. PMT ratenperpv fv type. The best way to calculate a monthly payment in Excel is by using the functions feature.

The syntax is as follows. If you want to make your own the PMT function in Excel coupled with other functions can be used to create a loan payment calculator. The number of payments is 10 years at 12 per year which is total of 120.

Microsoft Excel 2010 and 2013. In this formula the result of the PV function is the loan amount which is then subtracted from the purchase price to get the down payment. Calculate loan with Grace period Dear All.

What is the PMT Function in Excel. Excel 2010s PMT function calculates the periodic payment for an annuity assuming a stream of equal payments and a constant rate of interest. In the first period column enter 1 as the first period and then drag the.

The function is available in all versions Excel 365 Excel 2019 Excel 2016 Excel 2013 Excel 2010 and Excel 2007. I want to calculate the loan payment. This example teaches you how to create a loan amortization schedule in Excel.

Enter total value in the Principal row. This page is an advertiser-supported excerpt of the book Power Excel 2010-2013 from MrExcel - 567 Excel Mysteries Solved. This is how it can be done.

We are going to use the following formula. The function calculates by iteration and can have no or more than one solution. How to calculate a monthly payment in excel steps launch microsoft excel and open a new workbook.

Pin On The Master Key. To calculate a loan payment amount given an interest rate the loan term and the loan amount you can use the PMT function. RATE nper pmt pv fv type guess.

The location D3 in the table refers to interest rate and C3 in the datasheet refers to Price of ProductService. Use the PPMT function to calculate the principal part of the payment. Great for both short-term and long-term loans the loan repayment calculator in Excel can be a good reference when considering payoff or refinancing.

Since the rate is the rate is 5 a year and calculated monthly you must divide the interest rate by 12 as I did above. Know at a glance your balance and interest payments on any loan with this loan calculator in Excel. Furthermore you may want to keep the monthly payment at 400 per month but need to calculate the deposit.

PMT 0512120-50000 will return 53033. Excel for Office 365 Excel for Office 365 for Mac Excel 2016 Excel 2016 for Mac Excel 2013 Excel 2011 for Mac Excel 2010 Excel 2008 for Mac Excel 2007. Video walk through example demonstrating how to use the PMT function to calculate a loan payment amount.

When the function will be evaluated it will yield 6332 as shown in the screenshot below. Calculate a Loan Payment. Using Microsoft Excel you can calculate a monthly payment for any type of loan or credit card.

Now apply it over the whole Monthly Payment field by dragging the plus sign at the end of its cell to the bottom of the column. Calculates the loan amount. Just enter the loan amount interest rate loan duration and start date into the Excel loan calculator and it will calculate each monthly principal and interest cost through the final payment.

Label rows for Principal Interest Periods and Payment. If you want to calculate the total loancost you can use this formula B6B5 B6 is the payment per month B5 is the total number of payments months you can change as you need. How to calculate loan payments in excel 2010.

Click the first blank cell in the Payments row.

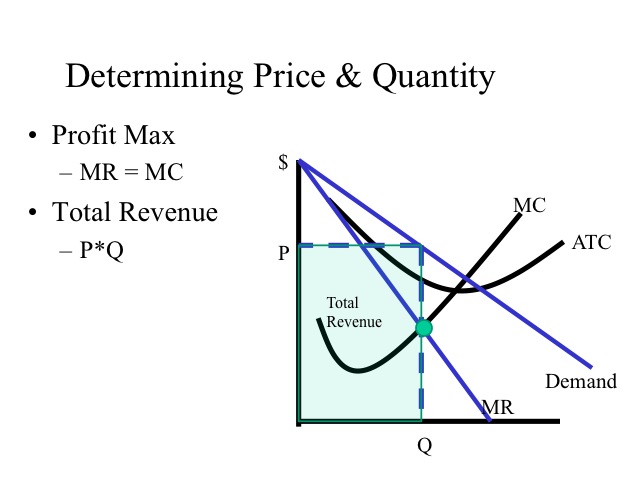

In this case we will assume that quantity is the amount of product that a business owner hopes to sell. The shaded box represents the TR.

Determine marginal cost by taking the derivative of total cost with respect to quantity.

How to calculate profit maximizing price and quantity. At a market price of 31 the firms total revenue equals 217 at a quantity of 7 31 times 7 and its total cost is given at 180. This calculation is the difference between the cost and selling price. One way to find the profit-maximizing quantity would be to take the derivative of the profit formula with respect to quantity and setting the resulting expression equal to zero and then solving for quantity.

Then subtract the firms total cost given in the table at each quantity. And so to understand how a firm might go about maximizing its profit or what quantity it would need to produce to maximize its profit based on this on its cost structure we have to introduce revenue into this model here. For each increment calculate total profit by subtracting total costs from total revenue.

Here it would choose a quantity of 40 and a price of 16. The quantity that maximizes profit is where marginal profit shifts from positive to negative. Calculating the quantity that will maximize profits requires that you understand the economic concept of marginal analysis.

Identify the point at which the marginal revenue and marginal cost curves intersect and determine the level of output at that. Find the profit equation of a business with a revenue function of 2000x 10x 2 and a cost function of 2000 500x. Determine marginal revenue by taking the derivative of total revenue with respect to quantity.

Simply calculate the firms total revenue price times quantity at each quantity. Profit priceaverage cost quantity 20027365 4745 profit price average cost quantity 200 273 65 4745. Next find total cost which is the area of the rectangle with the height of AC 1450 times the base of Q 40.

In order to maximize total profit you must maximize the difference between total revenue and total cost. Find the maximum profit in calculus. Total profit equals total revenue minus total cost.

TR PQ So we must find where MC MR and draw a vertical line down to the Quantity axis and find the Quantity which correlates to the Price chosen. As long as the calculator finds the profit it is also apt of working out mark up percentage and discounted selling prices. How a Monopolistic Competitor Chooses its Profit Maximizing Output and Price To maximize profits the Authentic Chinese Pizza shop would choose a quantity where marginal revenue equals marginal cost or Q where MR MC.

The profit maximizing quantity is given by Marginal RevenueMarginal Cost MRMC The MC is how much one extra unit of milk costs you which is 3. Calculate and graph the firms marginal revenue marginal cost and demand curves. Based on its total revenue and total cost curves a perfectly competitive firm like the raspberry farm can calculate the quantity of output that will provide the highest level of profit.

If the market price that a perfectly competitive firm receives leads it to produce at a quantity where the price is greater than average cost the firm will earn profits. As you can see this forms a rectangle and the area of the rectangle is the TR. In short three steps can determine a monopoly firms profit-maximizing price and output.

To calculate profit start from the profit-maximizing quantity which is 40. Next find total revenue which is the area of the rectangle with the height of P 16 times the base of Q 40. The first thing to do is determine the profit-maximizing quantity.

You will use this column to verify that total profit is maximized where marginal costs equal marginal revenue. The Profit Calculator works out the profit that is earned from selling a particular item. And in particular we are going to introduce the idea of marginal.

For the MR you can first write the Total Revenue. And a rational firm will want to maximize its profit. Substituting this quantity into the demand equation enables you to determine the goods price.

Set marginal revenue equal to marginal cost and solve for q. Marginal analysis is the study of incremental changes in profit. A monopolist can determine its profit-maximizing price and quantity by analyzing the marginal revenue and marginal costs of producing an extra unit.

Computing Profit for a Monopolistic Competitor. How to Calculate Maximum Profit in a Monopoly. The maximum profit will occur at the quantity where the difference between total revenue and total cost is largest.

If the marginal revenue exceeds the marginal cost then the firm can increase profit by producing one more unit of output. Calculus can be used to calculate the profit-maximizing number of units produced.