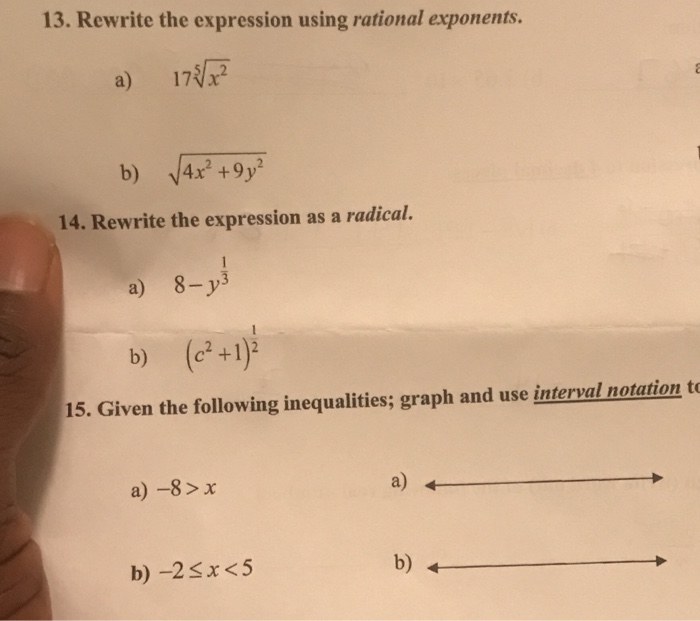

For example rewrite ⁶g⁵ as g⅚. 9 1 pair work practice with rational exponents 1 rewrite each radical using rational exponent notation.

Solved 13 Rewrite The Expression Using Rational Exponent Chegg Com

Let A be an n x n matrix whose characteristic polynomial splits.

Rewrite the expression using rational exponent notation. I made a typo and this expression is completely. 3947 Evaluate the expression without using a calculator. Determine the power by looking at the numerator of the exponent.

8 2 3 9. Rewrite the expression with a positive rational exponent. Since 4 is outside the radical it is not included in the grouping symbol and the exponent does not refer to it.

Provethat A and At have the same Jo. CONVERTING BETWEEN EXPONENTIAL AND RADICAL NOTATION We can use this definition to change any radical expression into an exponential expression. Order of Operations Factors Primes Fractions Long Arithmetic Decimals Exponents Radicals Ratios Proportions Percent Modulo Mean Median Mode Scientific Notation Arithmetics Algebra Equations Inequalities System of Equations System of Inequalities Basic Operations Algebraic Properties Partial Fractions Polynomials Rational Expressions.

Use nax ax n a x n a x n to rewrite x x as x1 2 x 1 2. Write with Rational Fractional Exponents. Exponents with answer key displaying top 8 worksheets found for this concept.

7 10 3 10 3 2 8 6 2 2 1 6 9 4 2 5 2 5 4 10 4 5 5 5 5 4 11 3 2 2 1 3 12. 337 5 2 Rewrite the expression using radical notation. 3 2 7 Evaluate the expression without using a calculator.

Express with rational exponents. EVALUATING EXPRESSIONS 813 Evaluate the expression without using a calculator. 3 5 xx3 5 Index is denominator 5 3 3 6 xx5 6 3 7 7 3 1 a a 2 3 3 2 1 xy xy exponent is numerator Negative exponents from reciprocals.

I dont know how rewriting the expression using rational exponent notation works. 3 points each Evaluate without a calculator. Sal solves several problems about the equivalence of expressions with roots and rational exponents.

Rewrite the expression using rational exponent notation. 1632 -125 USING RATIONAL EXPONENT NOTATION Rewrite the expression using rational exponent notation. Practice B For use with the lesson Evaluate nth Roots and Use Rational Exponents Rewrite the expression using rational exponent notation.

Given an expression with a rational exponent write the expression as a radical. We can also write radical expressions using a notation that involves rational exponents as follows. Let A be an n x n matrix whose characteristic polynomial.

In the expression 317 the 3 is called the _____. 4 points each Simplify the expression. Rewrite the radical using a rational exponent.

In this case the index of the radical is 3 so the rational exponent will be. Response times vary by subject and question complexity. You can enter fractional exponents on your calculator for evaluation but you must remember to use parentheses.

256 34 64 Type an integer or a. Median response time is 34 minutes and may be longer for new subjects. In this case the index of the radical is 3 3 so the rational exponent will be 1 3 1 3.

4 points Solve the equation. 4 x y 1 3 4 x y 1 3. 24 scaffolded questions that start relatively easy and end with some real challenges.

2 points Rewrite the expression using radical notation. 3 512 342 73 Thanks. 2 Rewrite the expression using radical notation.

Radical Expressions and Equations. Since 4 4 is outside the radical it is not included in the grouping symbol and the exponent does not refer to it. 256 34 256143 43 64-----Rewrite the expression.

Type exponential notation with positive exponents. N x x 1 n The definition remains the same for this notation. The key thing to realize here is the fourth root of something is same thing as something to the one fourth power.

Rewrite the expression using rational exponent notation. Rewrite the radical using a rational exponent. X1 2 x 1 2.

61 Evaluate nth Roots and Use Rational Exponents 1. Match the expression in rational exponent notation MATCHING. Determine the root by looking at the denominator of the exponent.

3 1 2 5. Rewrite the radical expression using rational exponents and simplify. For example would the square root of 3 be 312 which is 3 to the power of 12.

Rewrite with rational exponents. Do not simplify Second Part Now simplify. USING RADICAL NOTATION Rewrite the expression using radical notation.

2 points Rewrite the expression using rational exponent notation. The root determines the fraction. So here we have the fourth root of 5 a to the fourth b to the twelfth power.

If you are trying to evaluate say 15 45 you must put parentheses around the 45 because otherwise your calculator will think you mean 15 4 5. 256 34 Use integers or fractions for any numbers in the expression. Assume all variables are positive.

The root determines the fraction. Using the base as the radicand raise the radicand to the power and use the root as the index.

Have Siri automatically read messages aloud. The name of the sender is read aloud.

How To Get Siri To Read Your Messages Aloud

From that select Speak.

Siri read text messages out loud. When you are done with that Siri might read the message out loud for you to confirm what you said or send it instantly it will all depend on your settings. Siri is a digital assistant that recognizes natural language and performs tasks for you. After that open the conversation of the contact whose text messages you desire to read.

The central idea behind this Announce Message feature is to provide you easy access to your text messages without tapping through your Apple Watch or accessing your iPhone. Can anyone tell me how to stop Siri from reading my text messages out loud as I type them. Selecting the second allows you have Siri read everything that is visible on your screen.

There is an option in Apple that allows Siri to read out the text received. IPhone 4S iOS 613 Posted on Aug 5 2013 826 AM Reply I have this question too 2113 I have this. Getting Siri to read your messages out loud is a really handy usability improvement.

Enabling the first allows you to select a group of text and have Siri read that specific group back to you. 1 Open Settings on your iPhone iPad or iPod touch. Assuming youre using a recent iPhone and a recent version of iOS having your text messages read out loud is almost effortless.

With iOS 13 and a compatible set of earbuds Siri can read your texts to you in the privacy of your earbud audio. 4 Slide the switch next to Announce Messages with Siri to the ON position. A number of users have been asking about techniques to shut down their Siri reading out their text messages.

When you get a new message and Siri does the reading on your behalf immediately she stops speaking you are allowed to say Reply followed by what you wish to respond with. Follow the steps below to have Siri automatically read your latest incoming message out loud. Now my wish is fulfilled.

You can have Siri read out loud anything on your iPhone. Ever since the release of iOS 13 actually iOS 132 Siri has been able to automatically read your incoming text messages and iMessages aloud from your iPhone iPad or iPod Touch. After all you might be concentrating on something youre looking at er like the.

So to make your life easier we too have listed down steps that show how. Siri plays a tone then announces the senders name and reads the message. Disable Siri from reading out your text messages on Apple Watch This behavior of Siri is actually a feature that can be controlled via the Settings app.

Tap Notifications then tap Announce Messages with Siri. Turn on Announce Messages with Siri. With watchOS 7 any time you connect your AirPods to your Apple Watch or iPhone the toggle will become active.

This feature is quite useful when you are not in a mood to read. To have Siri read back your new text messages start Siri and say Check my messages Siri will tell you who your first message is from and begin reading it to you. 3 Tap Announce Messages with Siri.

One of the coolest things of Siri can do is read your texts read out loud to you. For example if you want Siri to read text messages open the Messages section. Since the dawn of Siri Ive wanted my iPhone to automatically read my text messages to me.

When you are sitting in the car or out on a walk at night Siri will announce your message contents as they arrive and save you the trouble of scrambling for. Siri to read incoming messages out loud when a. Once Siri has read the message youll be prompted to send a reply.

I know I do. How do I get Siri to stop reading my texts outloud as I type. With this you will get a menu.

Siri can then read that text out loud through your iPhones speaker at a pre-programmed speed. The feature has been available in iOS for a while and a lot of you might even be using it on your iPhone. When a message is received Siri will play a tone via the AirPods.

In such situations you can make use of it and listen instead. With this feature turned on Siri reads your incoming messages out loud when your headphones are connected to your iPhone or iPad youre wearing them and your device is locked. To enable this feature go to Settings General Accessibility and SpeechThen turn on Sp.

Having Siri by your side you can now command it to read anything you like while keeping up with your other works. All you have to do is ask Siri to read the message for you. If the message is fairly short Siri will read the entire message.

The latest beta version of messaging application Telegram has added a new feature for iOS users that lets Siri read and reply to text messages. AirPods have a message reading ability called Announce Messages with Siri And that is exactly what it does. Say youve got a bunch of unread text messages on your iPhone 4S and you dont want to tap through each one.

This happens when an option called Speak Auto Text is active on your phone. One of them is read text messages emails notes web pages and iBooks out loud for you. If you navigate to Settings General Accessibility and then Speak Selection you can enable the Siri feature on iOS 5.

On selecting the conversation long press on the message you want Siri to read out for you.

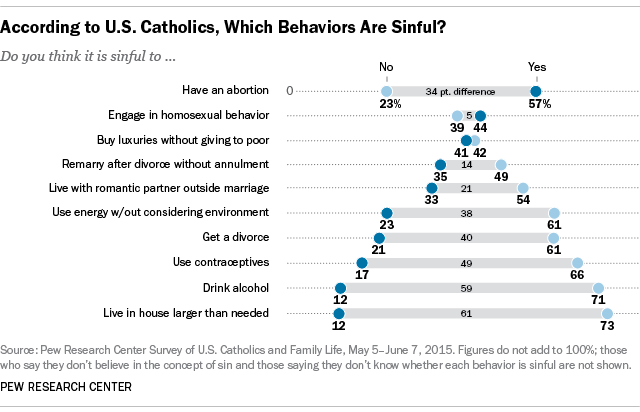

According to Catholic teaching sin is said to be either venial or mortal. It is recommended that for a full understanding on the Churchs teaching on sexuality this entire chapter be read.

Catholic Beliefs About Sin Pew Research Center

Full consent is present when one freely wills to commit an action although one clearly knows it is gravely sinful.

What is considered a sin in the catholic church. In 1975 the Congregation for the Doctrine of the Faith issued a Declaration on Certain Problems of Sexual Ethics and it is this document that the Catechism of the Catholic Church quotes regarding this issue. Both sins and blessings that are associated with the natural gift of sexuality must be understood within the context of Gods perfect plan for humanity. The Catechism of the Catholic Church categories individual sinfulness into venial and mortal sins.

Sin is a thought or action that is at root an offense against God. Mortal sin is sin whose object is grave matter and which is also committed with full knowledge and deliberate consent The sin against the Holy Ghost and the sins t. However a single mortal sin can determine ones eternal destiny after death.

See the main overview of Catholic morality for the big picture. The Catholic Church opposes all forms of abortion procedures whose direct purpose is to destroy a zygote blastocyst embryo or fetus since it holds that human life must be respected and protected absolutely from the moment of conceptionFrom the first moment of his existence a human being must be recognized as having the rights of a person among which is the inviolable right of every. In the Catholic Church sins come in two basic types.

He is dean of the Notre Dame Graduate School of Christendom College. Thomas and other doctors mortal sin is the sin which if unforgiven leads to eternal punishment. THE DEFINITION OF SIN 1849 Sin is an offense against reason truth and right conscience.

However some Catholic couples mistakenly believe that within marriage a husband and wife can make use of any kind of sexual acts with one another. The Catechism of the Catholic Church defines a mortal sin a sin that destroys charity in the soul as a sin whose object is grave matter and which is also committed with full knowledge and deliberate consent In his 1930 encyclical Casti Connubii Pope Pius XI taught that contraception is grave matter. This article is reprinted with permission from Arlington Catholic Herald.

A mortal sin in Catholic theology is a gravely sinful act which can lead to damnation if a person does not repent of the sin before death. Father William Saunders is pastor of Our Lady of Hope parish in Potomac Falls Virginia. The Roman Catholic Church divides sin into two categories.

Mortal sin is death to the soul. Furthermore when sin is considered from the point of view of the punishment it merits for St. It is failure in genuine love for God and neighbor caused by a perverse attachment to certain goods.

The following comes from Chapter 6 of the book My Catholic Morals. It is always a serious sin against God to have sex of any kind outside of marriage. The holy Roman Catholic Church teaches that sex outside of marriage is always gravely immoral.

1 The Catechism of the Catholic Church CCC defines a sin as follows. A sin is considered to be mortal when its quality is such that it leads to a separation of that person from Gods saving grace. Both the Magisterium of the Church in the course of a constant tradition and the moral sense of the faithful have.

The Sin of Suicide Arlington Catholic Herald. It is failure in genuine love for God and neighbor caused by a perverse attachment to certain goods. In defining gossip in a general way the term can merely apply to talk of a personal or trivial nature.

It wounds the nature of man and injures human solidarity. But the sin of gossip is more specifically considered to be idle talk or rumor especially. Three conditions must together be met for a sin to be mortal.

Sin is an offense against reason truth and right conscience. It wounds the nature of man and injures human solidarity. Venial sin is relatively minor in nature.

To answer this let us look first of all at the Churchs teaching. The Church believes that if you commit a mortal sin you forfeit heaven and opt for hell by your own free will and actions. The Church teaches that It causes a person to be separated from God.

Mortal sins that imperil your soul and venial sins which are less serious breaches of Gods law. It has been defined as an utterance a deed or a desire contrary to the eternal law. Sin is an offence against God.

Indifference to the laws of God is equivalent to disobeying them. In general sin refers to free choices that harm and break our relationship with God and with others. One commits venial sin when in a less serious matter he does not observe the standard prescribed by the moral law or when he disobeys the moral law in a grave matter but without full knowledge or without complete consent.

These two kinds of sins each injure the core component of being humanthe ability to love God and to love others. According to a new Pew Research Center study while 45 percent of Americans consider themselves Catholic only a fraction even know what acts are considered sins by the church in Rome and this. Whereas venial sin is the sin that merits merely temporal punishment that is a partial punishment which can be expiated on earth or in purgatory.

Its a violation of the great commandment to love God above all else and to love your neighbor as yourself. What is a Sin.

When calculating an assets useful life its important to remember that amount of time an asset is useful to a business may not always be the same as the assets entire lifespan. Effective Life Diminishing Value Rate Prime Cost Rate Date of Application.

Depreciation On Furniture Definition Rates How To Calculate

MANUFACTURING 11110 to 25990.

Useful life of furniture for depreciation. This is the same moment up to which directly attributable costs can be recognised as a part of the cost of PPE. Depreciation is calculated by considering useful life of asset cost and residual value. Companies use depreciation as a representation of the use for each asset in the company.

By dividing the furnitures purchase cost with its useful life. So some businesses opt to do it the simplest way. Assets with an estimated useful lifespan of 10 years include single-purpose agricultural or.

Different prevailing laws prescribe different rates for furniture depreciation. Broom and brush manufacturing plant. Generally under the US Prevailing laws furniture fixtures and related equipment life are assumed to be seven years in case of furniture is used in office locations.

The furniture useful life is the number of years it is expected to function properly with normal usage. Useful life specified in Part C of the Schedule is for whole of the asset. The depreciation provided is 25000 5000 Per Annum 5 yrs.

Furniture depreciation is only for long-term assets which are assets that will last longer than one year. The depreciation is already provided for 5 years as per 10 yrs. These provisions are applicable from 01042014 vide notification dated 27032014.

Furniture depreciation is a non-cash expense that slowly lowers the value of a business asset. Useful life for depreciation expenses. It is the taxpayer who initially determines the useful life and the tax regulations in the Philippines does not prescribe specific useful lives of certain properties though taxpayers have.

But you need to take into consideration that these standards are business standards. For example the depreciation of an asset purchased for 1 million with an estimated useful life of 10 years. The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed.

Depreciation rates are based generally on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives. A car would belong to the Automobiles Taxis business class with a useful life of 5 years and so on. Assets with an estimated useful lifespan of seven years include office furniture and other fixtures.

Useful life is the period within which the asset will be productive for use in the conduct of the trade or business. How long an asset is considered to last its useful life determines the rate for deducting part of the cost each year. All other depreciating assets require a useful life estimate.

The useful life of an asset is the period over which an asset is expected to be available for use by an entity or the number of production or similar units expected to be obtained from the asset by the entity. The value is depreciated in equal amounts over the course of the estimated useful life. For example if they bought the office furniture at 100 and is expected to be used within the next 5 years the yearly depreciation is 20.

An asset is depreciated over its useful life which is the period over which an asset is expected to be available for use by the entity IAS 166. The book value of a vehicle will be 30000 since life is revised as 12 years ie another 7 yrs instead of 5 yrs. Depreciation period useful life Depreciation starts when the asset is in the location and condition necessary for it to be capable of operating in the manner intended by management.

According to the IRSs Standard Useful Life Spans the useful life of office furniture is 7 years. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. Furniture and other manufacturing 25110 to 25990.

This ensures that companies accurately record expenditures and show the value they receive from each asset in the company. Property buildings and renovations. Where cost of a part of the asset is significant to total cost of the asset and useful life of that part is different from the useful life of the remaining asset useful life of that significant part shall be determined separately.

The useful lives of the assets for computing depreciation if they are different from the life specified in the Schedule. Depreciation Calculator for Companies Act 2013. Depreciation as per companies act 2013 for Financial year 2014-15 and thereafter.

For most depreciating assets you can use the ATOs determinations of effective life published in taxation rulings updated annually. For example office furniture belongs to the Office Furniture Fixtures and Equipment asset class which assigns a useful life of 7 or 10 years depending on the depreciation method used. For non-accountants calculating your office furniture depreciation can be confusing.

Learn more about useful life and depreciation including fixed asset depreciation accounting and the estimated useful life of assets.

The other half of the profits are considered retained earnings because this is the amount of earnings the company kept or retained. The retained earnings calculation is.

Statement Of Retained Earnings Definition Formula Example Financial Accounting Class Video Study Com

Like paid-in capital retained earnings is a source of assets received by a corporation.

How to reconcile retained earnings. A Statement of Retained Earnings should have a three-line header to identify it. Xero automatically calculates retained earnings based on the year end set in the orgs Financial Settings. Because all profits and losses flow through retained earnings essentially any activity on the income statement will impact the net income portion of the retained earnings formula.

An amount may need to be entered if the Retained Earnings balance consists of amounts prior to 1989. If there is an initial amount of retained earnings that is not reflected in Q3a enter year to date retained earnings as per the financial statements. On the first line put the name of the company.

Paid-in capital is the actual investment by the stockholders. Verify cash or stock dividends. If the client reflects any prior-period.

Those adjustments will flow down to schedule M-2 which will reconcile your equity as reported on your financial statement to that reported on the tax return. Correct the beginning retained earnings balance which is the ending balance from the prior period. Overview Step 1 - Execute transaction FAGLGVTR for new GL balance carryforward Transaction F16 for Classic GL.

Statement of retained earnings is a report that reconciles the retained earnings of a company at the start of an accounting period to retained earnings at the end of the accounting period. Get a schedule from your client that shows how the client got from beginning to ending retained earnings for the year. Thus the retained earnings balance is changing every day.

Step 3 - Check closing balance for the Retained. When dividends are declared by a corporations board of directors a journal entry is made on the declaration date to debit Retained Earnings and credit the current liability Dividends Payable. Beginning retained earnings Net income - Dividends Ending retained earnings.

However you cant simply select Retained Earnings from the Balance Sheet to view details. Beginning retained earnings corrected for adjustments plus net income minus dividends equals ending retained earnings. For example if beginning retained earnings were 45000 then the corrected beginning retained earnings will be 40000 45000 - 5000.

To do so follow these steps. When a new fiscal year starts QuickBooks Online automatically adds the net income from the previous fiscal year to your Balance Sheet as Retained Earnings. Trace the net income or loss adjustment to the clients income statement.

The retained earnings portion of stockholders equity typically results from accumulated earnings reduced by net losses and dividends. It is the declaration of cash dividends that reduces Retained Earnings. It reconciles how the beginning and ending RE balances.

Just like the statement of shareholders equity the statement of retained is a basic reconciliation. I see youve also seeked help from Support on this Samantha - Just get back to them to confirm the details if you need help locating the change. Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company and it is shown as the part of owners equity in the liability side of the balance sheet of the company.

The carry forward period of the. Calculating all of the prior profit and loss amounts plus any transactions coded directly to Retained Earnings creates the Retained Earnings balance. Your Retained Earnings account shows the total of your companys income and expenses from all previous years.

Going to the account register and adding or subtracting all the transactions with a checkmark in the cleared column calculates the opening balance for the reconciliation. The second line simply says Statement of Retained Earnings The third line should present the schedules preparation date as For the Year Ended XXXXX. Kelly M Community Manager 25 Aug 2016.

Where not populated and if required enter the respective retained earning balances in the Opening retained earnings cells. The general calculation structure of the statement is. The retained earnings calculation or formula is quite simple.

Step 2 - Check the cumulative PL year-end balance of 2012 with report RFSSLD00. The statement of retained earnings is most commonly presented as a separate statement but can also be appended to the bottom of another financial statement. Beginning retained earnings Net income during the period - Dividends paid Ending retained earnings.

When you complete your tax return you complete schedule M-1 that will reconcile your book income to the income reported on your tax return. Record a simple deduct or correction entry to show the adjustment. You can populate data from prior year workpapers using the Rollover Data function.

1 Opening Retained Earnings. Retained earnings is the investment by the stockholders through earnings not yet withdrawn. If your retained earnings end at 1100000 instead of 1225000 for instance you appear to have 125000 less in accumulated earnings than your prior years retained earnings and current years.