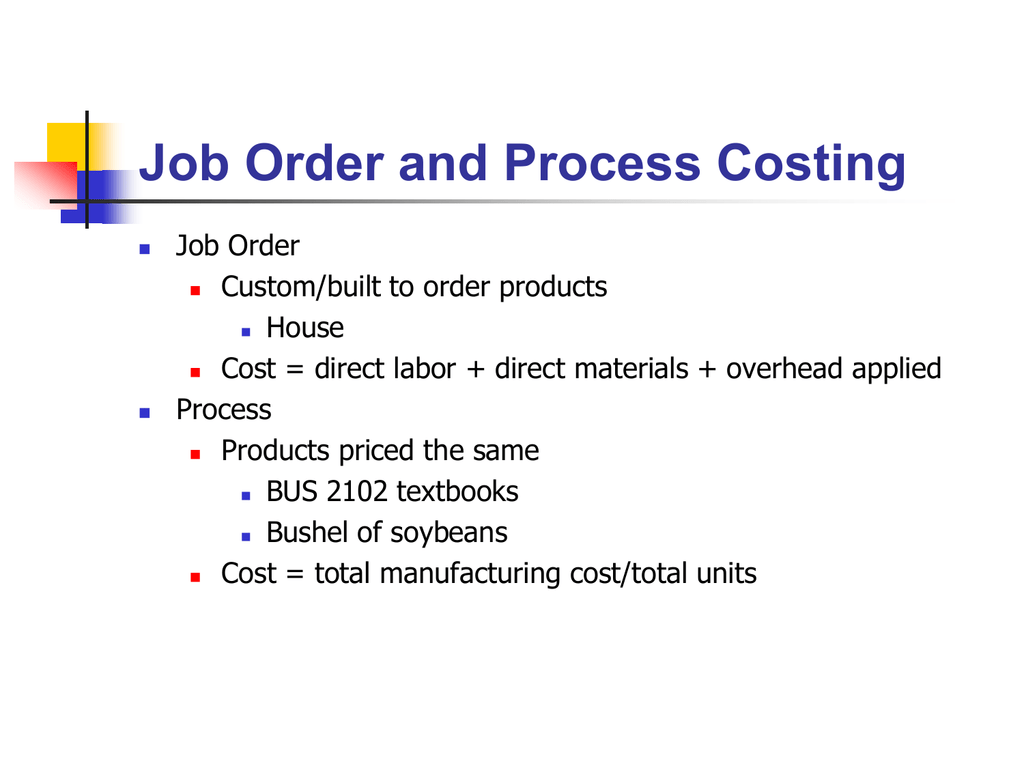

Job costing and process costing systems also have their significant differences. Job costing is more likely to be used for billings to customers since it details the exact costs consumed by projects commissioned by customers.

Process costing on the other hand is used when companies offer a more standardized product.

Job order costing and process costing are. Job order costing is an accounting system that traces the individual costs directly to a final job or service instead of to the production department. Process of Job Order Costing 1. That form of costing which applies where standardised goods are produced and production is in continuous flow the products being homogeneous.

The key difference between job order costing and process costing is that job costing is used when products are manufactured based on customer specific orders whereas process costing is used to allocate costs in standardized manufacturing environments. It is used when goods are made to order or when individual costs are easy to trace to individual jobs assuming that the additional information provides value. Each job must have its own identity which is called Job Code to make sure that all relevant.

Companies that use process costing produce a single product either on a continuous basis or for long periods. It is used when goods are made to order or when individual costs are easy to trace to individual jobs assuming that the additional information provides value. 81 Job Order v.

The process costing is used for the costing of more standardized products that are usually produced in large volumes. What is Job Costing. There are a few different types of process costing which can be used depending on your situation.

Process costing aggregates costs and so requires less record keeping. However in process costing the cost of each job is determined. Slide 312 Bhimani Horngren Datar and Rajan Management and Cost Accounting 5th Edition Pearson Education Limited 2012 Job-Costing and Process-Costing Systems Continued In a job-costing system the cost object is an individual unit batch or lot of a distinct product or service called a job.

Ii The job is the cost unit and costs are collected. The job order costing is used for the costing of products that are more unique and customizable. No matter who the customer is they all end up receiving the same product.

Process costing and job order costing are both acceptable methods for tracking costs and production levels. How to Calculate Process Costing. Job costing is used in cases where products produced are unique and process costing is used for the standardized products produced.

This is usually applied to small production orders. Process costing works better for things such as manufacturing aspirins. The type of costing method you use depends on the type of business youre running.

The system a company uses depends on the nature of the product the company manufactures. The job order costing is used for the costing of products that are more unique and customizable. Ultimately job order costing and process costing are cost accounting systems which are both viable the key is to identify unique circumstances and needs of your business.

Job Order Costing versus Process Costing. Every time materials withdraw from the warehouse the requested person needs to identify the job. Much more record keeping is required for job costing since time and materials must be charged to specific jobs.

Companies that use job costing work on many different jobs with different production requirements during each period. Difference between Job Costing and Process Costing. Process Costing Job Order Costing versus Process Costing.

A hand carved marble statue would get job order costing. Job Order Costing vs Process Costing As an example law firms or accounting firms use job order costing because every client is different and unique. Job order costing looks at how much an individual item costs to manufacture.

Job costing refers to calculating the cost of a special contract work order where work is performed as per clients or customers instructions. Job costing is used for very small production runs and process costing is used for large production runs. In job costing the cost is calculated after the completion of the job.

Process costing looks at the cost of making thousands or millions of individual items. A costing method in which the costs which are charged to various processes and operations is ascertained is known as Process Costing. Job order costing is an accounting system that traces the individual costs directly to a final job or service instead of to the production department.

Some companies use a single method while some companies use both which creates a hybrid costing system. Types of products produced. Job Costing Process Costing i The form of specific order costing which applies where the work is undertaken to customers special requirements.

Job costing also known as job order costing and process costing are cost accounting systems designed to help businesses keep track of all the costs they have to pay to produce a product or deliver a service. Job order costing and process costing are systems of collecting and allocating costs to units of production. This applies to products that are produced in small volumes whereas process costing is used for the costing of more standardized products that are usually produced in large volumes.

This categorization is essential mainly because of two reasons. Unlike normal spoilage abnormal spoilage is charged as expenses incurred or is entered as a separate cost Inventoriable Costs Inventoriable costs also known as product costs refer to the direct costs associated with the manufacturing of products for revenue that can no longer be recovered.

Solved Fifo Method Spoilage Refer To The Information In Prob Chegg Com

When however the normal spoiled units are used again as raw material in the same manufacturing process no separate treatment becomes necessary.

Spoilage in process costing. When spoilage creates costs in a process-costing environment you apply the following methods to account for them. Occurs at a specific inspection point. Its quantum can be evaluated or analyzed at various points of time it can be reduced further if possible by improving the process or technology.

Overhead is allocated to jobs based on direct. _____ TYPES OF LOST UNITS CONTINUOUS LOSS occurs fairly uniformly throughout the production process DISCRETE LOSS assumed to occur at a specific point ACCOUNTING FOR LOST UNITS The method of accounting for the cost of lost units depends on whether the loss is considered normal. Change to Equivalent Units Schedule.

Many factors like shrinkage seepage evaporation weight loss and use of inefficient equipment often cause a loss or spoilage of units in processing departments. Spoilage Rework and Scrap. Standard costing method spoilage journal entries.

For example some companies do not include the number of units spoiled in the unit cost. Add two rows below ending inventory. Process costing with spoilage step 1.

Spoilage is calculated as part of process costing. Conversion costs are added evenly during the production process. This means that the cost of normal spoilage may initially be recorded as an asset and then charged to expense in a later period.

The company manufactures custom products and uses a job order system. When Job 512 was being processed in the machining department a piece of sheet metal was off center in the bending machine and two vents were. Process Costing and Spoilage In.

EUP for each element Allocation of. That is for every 10 good units produced there is 1 unit of normal spoilage. One example is a manufacturing company for doughnuts whose normal spoilage is 5000 donuts or 5 of the total production of 100000 doughnuts a day.

The company uses a process-costing system to account for its work-in-process inventories. The loss is discovered at the inspection point. Business and Management Submitted By sharafaas Words 6221 Pages 25.

If less normal spoilage is incurred than excepted this is recorded as an unexpected gain. Beginning inventory consisted of 1 000 units with costs of 21 000. Physical flow 5500 26000 5500 Opening WIP transferred in from assembly dept Completed units opening.

Spoilage is also that part of the final produce that does not adhere to the specifications given by the client and is therefore not accepted by them. There are some alternative methods of accounting for spoilage in process costing. 1 BA 119 2nd Semester AY 2013-2014 Process Costing Spoilage Exercise Surname.

Companies usually calculate expected spoilage rates for different products assigning the amount of spoilage they expect to the cost of goods sold. View Process Costing and Spoilagexlsx from BUSI 354 at University of British Columbia. Week 15 Distance Student File 1 of 35 Problem 7 Job Order Costing Jessica Company started operations on January 2 20x6.

In routine accounting abnormal spoilage is reported to managers above the shop floor personnel. The difference between rework and spoilage is that rework will be reworked on and sold at full price whereas spoilage is considered to be defective goods and is discarded at throw away prices in the market. Normal spoilage and Abnormal spoilage.

Spoilage Rework and Scrap. Produksi dan mengalokasikan biayanya ke semua unit yang terlah melewati titik tersebut selama periode akuntansi-Job Costing and SpoilageSistem job costing biasanya membedakan antara kerusakan normal yang disebabkan oleh pekerjaan tertentu dengan kerusakan normal. Occurs fairly uniformly throughout the production process No inspection point to discover the spoilage.

Normally spoiled units are 10 of the finished output of good units. Cost accounting for abnormal spoilage accountants post the cost of abnormal spoilage to a loss for abnormal spoilage account. Some units of this product are spoiled as a result of defects which are detectable only upon inspection of finished units.

In cost accounting process costing assumes that all units produced are identical. Accounting for Spoilage In accounting normal spoilage is included in the standard cost of goods while abnormal spoilage is charged to expense as incurred. In process costing this loss of units is categorized as normal and abnormal loss.

Cost accounting for abnormal spoilage Accountants post the cost of abnormal spoilage to a loss for abnormal spoilage account. This categorization is essential mainly because of two reasons. In case of abnormal spoilage cost of spoilage is transferred to Costing Profit and Loss Account.

When assigning costs job-costing systems generally distinguish normal spoilage attributable to a specific job from normal spoilage common to all jobs. Cost accounting practice recommends normal spoilage is specified as part of production process specification. Jordan Inc is a manufacturer of vents for water heaters.

Cero Ariel Tapel Use Method of Neglect Excludes spoiled units in the equivalent units schedule Spreads cost of lost units proportionately over the good units transferred and those remaining in WIP inventory Required. Normal spoilage costs in job-costing systems as in process-costing systems are inventoriable costs although increasingly companies are tolerating only small amounts of spoilage as normal.