My Cheat Sheet Table begins by illustrating that source documents such as sales invoices and checks are analyzed and then recorded in Journals using debits and credits. Making a profit keeps you in business so follow the financial statements closely make adjustments if needed and follow some basic rules for presenting.

Accounting Journal Entries Cheat Sheet Accounting Career Quickbooks Journal Entries

Get the Forex Chart Patterns cheat sheet learn how to differentiate similar patterns using highs and lows and how to choose patterns that suits your trading style using the patterns characteristics.

Journal entry cheat sheet. It is a work in progress and is not finished yet. It is a result of accrual accounting Accrual Accounting In financial accounting accruals refer to the recording of revenues that a company has earned but has yet to receive payment for and the and follows the matching and revenue recognition. The technical analysis patterns cheat sheet is a Meta trader forex sheet that helps the traders to identify different patterns in the forex marketin technical analysis of forex market rise and fall in the market trends and these rising and falling trends are known as price patterns of the forex market because in the forex market rise and fall in price is the reason for supply and demand of the currency pairs.

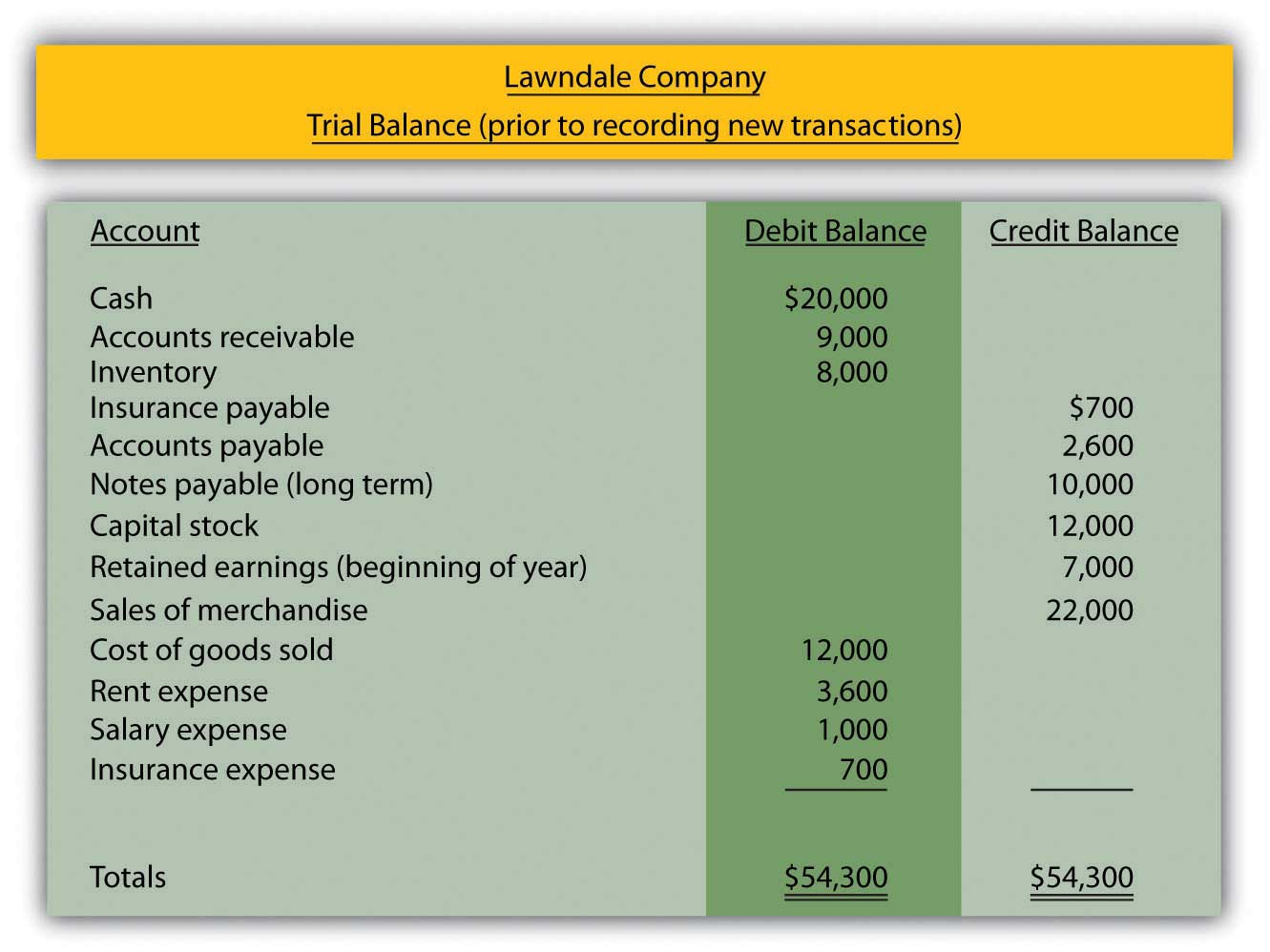

Adjusting Entries Cheat Sheet DRAFT by Cshortla. Current asset will turn to cash within one year of the date of the balance sheet unless the operating cycle is greater than one year. Youll find a cheat sheet that explains debits and credits and a number of examples that explain the concepts.

Show new log entries as they are added. Use of Financial Statements by Outsiders Page 5 4. This cheat sheet works as guide for student with specific summarized information of double entry accounting.

October 30 2020 Indicators Trading system. Effect on Income Statement. The executable path and the command line of the process the journal entry originates from.

First open up this cheat sheet page in a separate browser page so you can refer to it as we decide how to book this entry. I hope this cheat sheet helps you get started with some quick options. Classified balance sheet groups assets into the following classification.

Accounting Cycle Cheat Sheet Accounting Equation Cheat Sheet Adjusting Entries Cheat Sheet Balance Sheet Cheat Sheet Bank Reconciliation Cheat Sheet Cash vs Accrual Acc. JOURNAL ENTRY CHEAT SHEET JOURNAL ENTRY HELPFUL HINTS If an Account number begins with a 1 2 or 3 a balance sheet account the Tcode is either B410 for a credit - or B411 for a debit. Adjusting Entries Cheat Sheet.

The debit-credit cheat sheet is usually for a study. Every entry needs debits and credits. Table of Contents 1.

The journalctl system takes system logging to the next level. Forms of Business Organization Page 4 3. This is a draft cheat sheet.

Liabilities are classified as either current or long-term. So lets figure out our debits first. As a business manager taking care of your companys accounting needs is top priority.

Balance Sheet as of 12312100 Income Statement year ended 12312100 Net income increases RE T-Account Revenue Debit Credit Expense Equity Equation Assets Liabilities Equity Equity Assets - Liabilities - COGS Journal Entry debit credit Cash 100 Common stock 100 Receive cash for common stock. AWS Identity and Access Management IAM AWS IAM in the AWS services cheat sheet is one of the oldest entries. The biggest Accounting Stuff Cheat Sheet bundle ever.

The -F option can be used to show all of the available values for a given journal field. If an Account number begins with a 4 or 5 a revenue account the Tcode is either 410 for a credit - or 411 for a debit. These Journals are then summarized and the debit and credit balances are Posted transferred to the General Ledger Accounts and the amounts are posted to the left side of the.

Journalctl Cheat Sheet by airlove. Simple Ledger Page 6 5. Effect on Balance Sheet.

Adjustments Flow Chart. Query the systemd Journal. Accounting Equation Cheat Sheet.

Such as equity entries accounting balancing ledger entries assets transactions etc. A collection of Cheat Sheets that I have carefully put together to help you remember the key principles of Accounting. To see all the options be sure to read the man page.

Each general journal entry lists the date the account title s to be debited and the corresponding amount s followed by the account title s to be credited and the corresponding amount s. The accounts to be credited are indented. Closing Entries Cheat Sheet.

This Mega Pack contains a zip file made up of all 19 pdfs. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Lets illustrate the general journal entries for the two transactions that were shown in the T-accounts above.

If the student knows about debits and credits at the appropriate level this cheat sheet will be helpful to increase the knowledge with specific details. The entry must total zero when you are finished if you want to remain balanced. The purpose of my cheat sheet is to serve as an aid for those needing help in determining how to record the debits and credits for a transaction.

Small business bookkeeping uses double entry bookkeeping. AWS Resource Access Manager RAM Resource Access Manager service helps in easily sharing AWS resources with the highest security possible. Correctly preparing a financial statement involves knowing all the information that needs to appear on the statement.

The common entries in AWS cheat sheet in this category are as follows. GENERAL ACCOUNTING CHEAT SHEET This sheet is not for unauthorized distribution. IAM is the go-to option for managing access to AWS services and resources with high security.

Cash Control Management Page 7 6. Balance Sheet Assets Liabilities Shareholders Equity Pages 2 and 3 2. Current assets investments property plant and equipment and other assets.

Definition To define debits and credits you need to understand accounting journals.

Accounting ALL-IN-ONE by Ken Boyd Lita Epstein Mark P. Under the contract Platform will be paid EUR 1000 per kilometer for 12000 minimum guaranteed kilometers per annum.

In this episode of Accounting Basics for Beginners I explain Jour.

Accounting journal entries for dummies. What is the Purpose of Journal Entries. The cards are sold for cash and in effect the customer is prepaying for the goods. Entered into a 1-year contract with a multinational financial services giant to provide air transport to its executives.

Example Journal Entries. Journal entries are a way to record financial transaction. The journal entry may also include a reference number such as a check number.

Payment shall be made at the end of each quarter. However the bottom line is that all the debits of the journal entry must equal all the credits of the same entry. Hedge accounting The new requirements on hedge accounting were finalised in November 2013.

Thats the cardinal rule of double-entry bookkeeping. Although many companies use accounting software nowadays to book journal entries journals were the predominant method of booking entries in the past. In addition to pension accounting companies also have to provide other benefits that are treated similarly to pensions from an accounting perspective.

They are chronological accounting records each one composed of a debit and a credit. On 1 December 2015 Platform Inc. They are a day-to-day recording of events.

You ll get up to speed on. This is seen in several companies in the United States. Setting up your accounting system.

Accounting AllinOne For Dummies is a comprehensive resource on a variety of accounting concepts. The accounting done by the company with respect to the hedge of exposure of fair value change of the item be it a asset for the company or it is a liability that is attributable to the particular risk and the same can result in profit or loss generation to the company is known as the Accounting for the Fair Value Hedges. Adjusting and closing entries.

Tracy and Jill Gilbert Welytok. Preparing income statements and balance sheets. Consider the following diagram.

This is a great Accounting tutori. Accounting for Other Benefits. Journal entries are important because they allow us to sort our transactions into manageable data.

Holtzman Frimette Kass-Shraibman Maire Loughran Vijay S. Journals or journal entries are simply records of individual transactions in chronological date order. Youll notice the above diagram shows the first step as Source Documents.

Handling cash and making purchase decisions. Every transaction that gets entered into your general ledger starts with a journal entry that includes the date of the transaction amount affected accounts and description. Disposal of Fixed Assets Journal Entries Accounting for Disposal of Fixed Assets When a business has a disposal of fixed assets the original cost and the accumulated depreciation to the date of disposal must be removed from the accounting records.

When doing journal entries we must always consider four factors. The purpose of journal entries is to keep a day-to-day chronological record of a business and its transactions. The result is that at any point of time companys accounting remains in balance.

Accounting For Gift Cards Gift cards or gift certificates are sold by a business to customers to allow them to purchase products at some future date. In every journal entry that is recorded the debits and credits must be equal to ensure that the accounting equation Assets Liabilities Shareholders Equity remains in balance. Planning and budgeting for your business.

Journal Entries Cheat Sheet httpsaccountingstuffcoshopAccounting Basics Lesson 4. It simultaneously records a debit and a credit to a particular account balance. For example some companies continue to pay for medical services used by former employees who have retired.

All over the world double-entry system of accounting is used to record financial transactions. Hence an adjusting journal entry to record an accrual will impact both the income sheet and the balance sheet of a business. In the following General Ledger entry note that the debits and credits are in balance at 2900 each.

But accounting journals record business transactions taking place within a companys accounting department. The next step in the accounting cycle is to record the financial transactions in the appropriate accounting journals of the business. What Are Accounting Journals.

The journal entries should be done in chronological order debiting one or more accounts and crediting one or more accounts ensuring that the debits and credits are in balance. A Cash Receipts journal tracks transactions in which the business receives cash. A double-entry journal can comprise more than one debit entry or more than one credit entry.

Journal entries are how transactions get recorded in your companys books on a daily basis. All entries to the General Ledger must be balanced entries. A Journal Entry is simply a summary of the debits and credits of the transaction entry to the Journal.

Accounting journals are a lot like the diary you may have kept as a child or maybe still keep. It is important to note that while these changes provide the general hedge accounting requirements the Board is working on a separate project to address the accounting for hedges of open portfolios usually referred as macro hedge accounting. Which accounts are affected by the transaction.