The key difference between horizontal and vertical analysis is that horizontal analysis is a procedure in financial analysis in which the amounts in financial statements over a certain period of time is compared line by line in order to make related decisions whereas vertical analysis is the method of analysis of financial statements where each line item is listed as a percentage of another item. The vertical analysis shows the financial position of the business on based of lined up numbers.

Horizontal And Vertical Analysis Youtube

Understanding horizontal and vertical analysis is essential for managerial accounting because these types of analyses are useful to internal users of the financial statements such as company management as well as to external users.

Horizontal and vertical analysis. To get a clear picture of the performance of our business we need to do a horizontal analysis of each item in our income statementA complete horizontal analysis of income statement might tell us that while our sales figure increased by 6667 our profits. Vertical analysis also called common-size analysis focuses on the relative size of different line items so that you can easily compare the income statements and balance sheets of different sized companies. The horizontal analysis considers all the amounts in financial statements over many years while vertical analysis takes into account the amounts present in the financial statements separately as a percentage of the total.

An evaluation of one process or activity across several groups or departments within an enterprise. On the other hand vertical analysis is used in the comparison of a financial item as a percentage of the base figure commonly total liabilities and assets. Lets go back to our income statement items for Apple and Google.

Whereas the opposite of the vertical analysis of financial statements is the Horizontal analysis always looks at the amount from the financial statement over the horizon of many years. Under vertical analysis or common-size analysis one lists each line item in the financial statement as a percentage of the base figure. Horizontal analysis can also be compared with vertical analysis.

The amounts from past financial statements will be restated to be a percentage of the amounts from a base year. The horizontal analysis compares the figures under the head of financial statement and vertical analysis compared the numbers and percentage. Horizontal Analysis of an Income Statement.

Shareholder equity divided by total assets- 16355 29427 1. Horizontal Analysis of Financial Statements is one of the most important techniques to find out how a company is doing financially. It can be applied to the same documents but is exclusively percentile-based and travels as the name implies vertically within each period across periods rather than horizontally across periods.

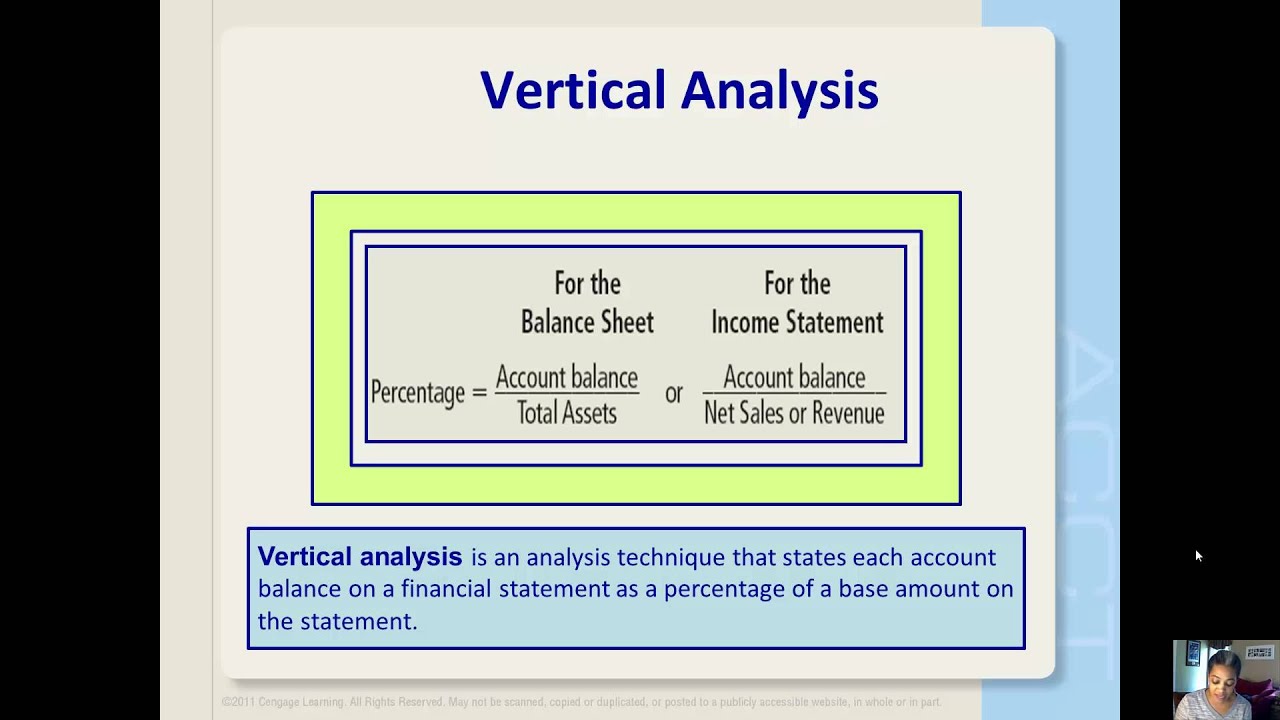

It is used for evaluating trends year over year YoY or quarter over quarter QoQ. What is Vertical Analysis. Vertical Analysis Like horizontal analysis vertical analysis is used to mine useful insights from your financial statements.

Vertical analysis is proportional evaluation of the financial statement wherein each item on the statement is expressed as a percentage of the total in the respective section. Two measures of vertical analysis. The statements for two or more periods are used in horizontal analysis.

Vertical analysis can become a more potent. Horizontal analysis just compares the trend of the item over many periods by comparing the change in amounts in the statement. A horizontal audit is appropriate for processes and activities that are.

Whereas vertical analysis analyzes a particular financial statement using only one base financial statement of the reporting period horizontal analysis compares a specific financial statement with other periods or the cross-sectional analysis of a company against another company. Horizontal analysis is the comparative evaluation of the financial statement for two or more period to calculate the absolute and relative variances for every line of item. Horizontal analysis involves the calculation of percentage changes from one or more years over the base year dollar amount.

Vertical Analysis is one of the financial analysis methods with the other two being Horizontal Analysis and Ratio Analysis. Horizontal analysis is used to indicate changes in financial performance between two comparable financial quarters including quarters months or years. Horizontal analysis is also referred to as trend analysis.

Horizontal Analysis doesnt conclude with finding the change in sales over a period. For instance showing selling expenses as the percentage of gross sales. Current assets divided by total assets- 10250 29427 2.

Horizontal analysis also known as trend analysis is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of timeIt is a useful tool to evaluate the trend situations. Vertical analysis makes it easier to understand the correlation between single items on a balance sheet and the bottom line expressed in a percentage. Horizontal analysis looks at amounts from the financial statements over a horizon of many years.

Differing from total percentages from one financial statement is horizontal analysis. The base year is typically the oldest year and is always stated as 100. In the vertical analysis the assets liabilities and equity is presented in the form of a percentage.

Both analyses involve comparing income statement accounts to each other in dollars and in percentages. Horizontal analysis and vertical analysis are two types of trend analyses. In the vertical analysis of financial statements the percentage is calculated by using the below formula.