Introduction A financial system that is based on Islamic principles and values which eliminates riba and ensure a profit sharing mechanism in the financial system. PRINCIPLES OF AN ISLAMIC FINANCIAL SYSTEM The basic framework for an Islamic financial system is a set of rules and laws collectively referred to as Shariah governing economic social political and cultural aspects of Islamic societies.

In fact Islam prohibits earning of money through unfair trading practices and other activities that are socially harmful in one way or another.

Islamic financial system definition. Two fundamental principles of. This forces credit to be either interest-free or more commonly to take the form of a partnership or joint venture. Banking or banking activity that complies with sharia Islamic lawknown as Islamic banking and finance or shariah -compliant finance has its own products services and contracts that differ from conventional banking.

All banks commercial financial institution and development financial institutions will seek and provide finances which will always have some clement of risk-bearing. The Islamic financial system is based on equity whereas the conventional banking system is loan based. Conventional finance particularly conventional banking business relies on taking deposits from and providing loans to the public.

The range of financial transactions that conform to the sharia or Islamic law. One of the main principles of the Islamic finance system is the prohibition of the payment and the receipt of riba interest in a financial transaction. There is no interest in the economy.

Islam is not against the earning of money. Islamic finance forbids investment in industries considered sinful notably alcohol pornography and armaments. Just like conventional financial systems Islamic finance features banks capital markets fund managers investment firms and insurance companies.

The Sharia literally meaning a clear path to be followed and observed - promotes first the principle of profit-loss sharing between financial institutions and entrepreneurs thus emphasizing the spirit of cooperation in business which would help absorb the weight of loss when sharing it equitably. Introduction A financial system that is based on Islamic principles and values which eliminates riba and ensure a profit sharing mechanism in the financial system. According to economist and Islamic finance critic Feisal Khan a true or strict Islamic banking and finance system of profit and loss sharing the type supported by Taqi Usmani and the Shariah Appellate Bench of the Supreme Court of Pakistan would severely cripple central banks ability to fight a credit crunch or liquidity crisis that leads to a severe recession such as happened in 2007-8.

BPMS1013 Theory Practice of Islamic Business 3. Islamic banking also referred to as Islamic finance or shariah-compliant finance refers to finance or banking activities that adhere to shariah Islamic law. It may be characterized by the absence of interest based financial institution and transactions doubtful transactions or gharar stocks of companies dealing in unlawful activities unethical or immoral transactions such as market.

Job Titles in Banking and Finance These are the most common banking finance and accounting job titles for students and professionals looking to advance their careers. Islamic law also forbids the payment or receipt of interest. Basic principles of capitalism must be changed considerably to fit Islamic economics but it must be said that some of the foundations are similar in terms of acquisition of wealth.

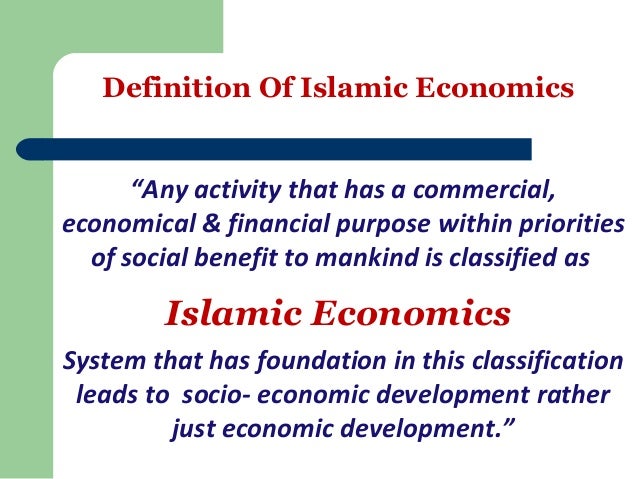

Islamic finance is a type of financing activities that must comply with Sharia Islamic Law. Islamic finance is a financial system that operates according to Islamic law which is called sharia and is therefore sharia-compliant. It also refers to the types of investments that are permissible under this form of.

An Islamic financial system avoids interest and interest-based assets Hassan and Lewis 2007 offered a comprehensive description of Islamic modes of financing which are based on profit and loss sharing investment types of risks in Islamic banking and financial innovations including access to capital markets and securitization introduced by Islamic banks and thus restricts speculation Speculation may create a disconnect between the market price of an asset eg common stock house. Islamic finance is a term that reflects financial business that is not contradictory to the principles of the Shariah. It may be characterized by the absence of interest based financial institution and transactions doubtful transactions or gharar stocks of companies dealing in unlawful activities unethical or immoral transactions such as market manipulation insider trading short-selling etc.

Therefore the banker-customer relationship is always a debtor-creditor relationship. Briefly speaking we are talking of a system with the following features. The term Islamic finance is used to refer to financial activities conforming to Islamic Law Sharia.

Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia or Islamic law. The concept can also refer to the investments that are permissible under Sharia. Financial capital can cam income only by bearing and sharing risk of losses.

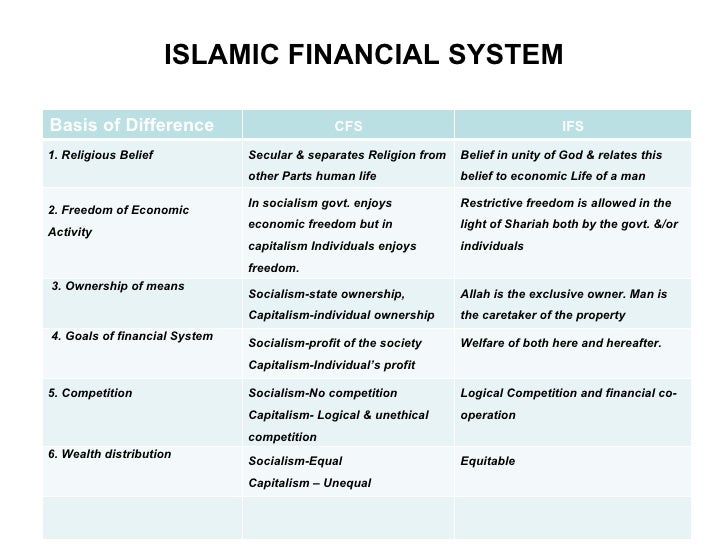

The key characteristic of Islamic economics is that economic and financial activities are linked to real economic sector activities and there is encouragement to equity based structures backed by tangible assets instead of debt based ones in investment where in the conventional world the transactions may not necessarily have to be backed by any real asset. The Islamic Economic System is markedly different to capitalistic socialistic communistic and mixed economic systems. The common practices of Islamic finance and banking.