In other words an ascending order will be followed. X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 - APA Paste BIU A Cells Editing Alignment Number Conditional Format As Cell Formatting Table Styles.

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

The costs paid for those recent products are the ones used in the calculation.

Lifo cost of goods sold. The higher cost of goods sold generally results in smaller amounts of gross profit net income taxable income income tax payments and certain financial ratios. Difference between FIFO LIFO and Average Inventory System. FIFO stands for First In First Out and is an inventory costing method where goods placed first in an inventory are sold first.

Recently-placed goods that are unsold remain in the inventory at the end of the year. If you sell three units during the period the LIFO method calculates the cost of goods sold expense as follows. Cost of Goods Sold FIFO 2000 3000 2000 3000 2 0 0 0 3 0 0 0.

Round average-cost per unit and final answers to 0 decimal places eg. To obtain a better matching of current revenues with current costs in times of inflation. COGS FIFO 5000 5000 5 0 0 0.

It is a method used for cost flow assumption purposes in the cost of goods sold calculation. In the above example the cost of 250 units had to be determined. Instead of selling its oldest inventory first.

LIFO stands for Last-In First-Out. The ending inventory cost of the one unit not sold is 100 which is the oldest cost. 106 104 102 312 With LIFO you use the last three units to calculate cost of goods sold expense.

Compute the cost of the ending inventory and the cost of goods sold under FIFO LIFO and average-cost. The amount a company reports as inventory on the balance sheet at. X 5 त 5 Inventory Costing Methods - Excel.

Calculate Cost Of Ending Inventory And Cost Of Goods Sold Using Periodic FIFO LIFO And Weighted Average Cost Methods. This method is the opposite of FIFO. Under LIFO COGS was valued at 37000 because the 3000 units that were purchased most recently were used in the calculation or the January February and March purchases 10000 12000.

We have step-by-step solutions for your textbooks written by Bartleby experts. Adjust the financial statements for inflation. If the units sell for 1000 each then the gross profit is calculated as follows.

To calculate FIFO First-In First Out determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold whereas to calculate LIFO Last-in First-Out determine the cost of your most recent inventory and multiply it by the amount of inventory sold. If Corner Shelf Bookstore sells the textbook for 110 its gross profit under the periodic average method will be 22 110 - 88. Last in first out LIFO is another inventory costing method a company can use to value the cost of goods sold.

Using LIFO the ending inventory is valued at 1900 and cost of goods sold is 1200. Items a company intends for sale to customers Inventory is reported as a current asset on the balance sheet because it is a valuable resource that the company expects to convert to cash in less than one year. It is an inventory costing method where the goods placed last in an inventory are sold first.

Gross profit Revenue - COGS Gross profit 200 x 1000 - 1200 Gross profit 800 FIFO vs LIFO Comparison of Gross Profit. The LIFO method assumes that the most recent products added to a companys inventory have been sold first. The default inventory cost method is called FIFO First In First Out but your business can elect LIFO costing.

FIFO First-In First-Out assumes that the oldest products in a companys inventory have been sold first and goes by those production costsThe LIFO Last-In First-Out method assumes that the most recent products in a companys inventory have been sold first and uses those costs instead. The major objectives Of the LIFO method to change the cost of goods sold with the most recent cost incurred. Textbook solution for Using Financial Accounting Information 10th Edition Porter Chapter 5 Problem 522MCE.

The FIFO First-In First-Out method means that the cost of a companys oldest inventory is used in the COGS Cost of Goods Sold calculation. LIFO stands for Last In First Out. Since LIFO last-in first out is moving the recenthigher costs to the cost of goods sold the olderlower costs remain in inventory.

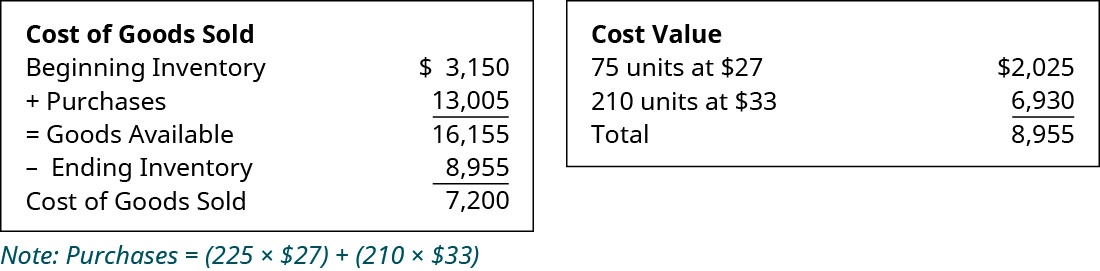

LIFO which stands for last-in-first-out is an inventory valuation method which assumes that the last items placed in inventory are the first sold during an accounting year. The total of the cost of goods sold plus the cost of the inventory should equal the total cost of goods available 88 352 440. FIFO First in First Out means that the inventory which has been received first will be sold first.

FIFO and LIFO are methods used in the cost of goods sold calculation. សមសវគមនមកកន Channel YouTube KH Study OnlineKH Study Online. CHAPTER 6 INVENTORY AND COST OF GOODS SOLD UNDERSTANDING INVENTORY AND COST OF GOODS SOLD Inventory.